As a Mid-Revenue Cycle Director, one key area of responsibility is charge capture and reconciliation. These crucial areas ensure that your healthcare organization is billing appropriately and receiving all due payments.

New to your role? In the first 90 days, monitoring and optimizing charge capture and reconciliation processes is essential for improving revenue cycle performance, reducing denials, and enhancing overall financial health.

In this blog, you’ll learn:

- The KPIs and charge capture analytics to monitor in your role as a Mid-Revenue Cycle Director

- Benchmarks for those KPIs so you can measure yourself accordingly

- How medaptus’ Charge Pro solution helps you report on these KPIs

First 30 Days: Understanding, Assessing, and Building Relationships

KPIs to Focus On:

1. Charge Capture Accuracy Rate

- Definition: Percentage of charges captured accurately and in a timely manner for each service rendered.

- Industry Benchmark: 95% to 98% accuracy.

- Why it matters: Inaccurate charge capture can result in missed revenue or delayed billing. This rate helps identify whether your team is correctly capturing all services provided, reducing the risk of revenue leakage.

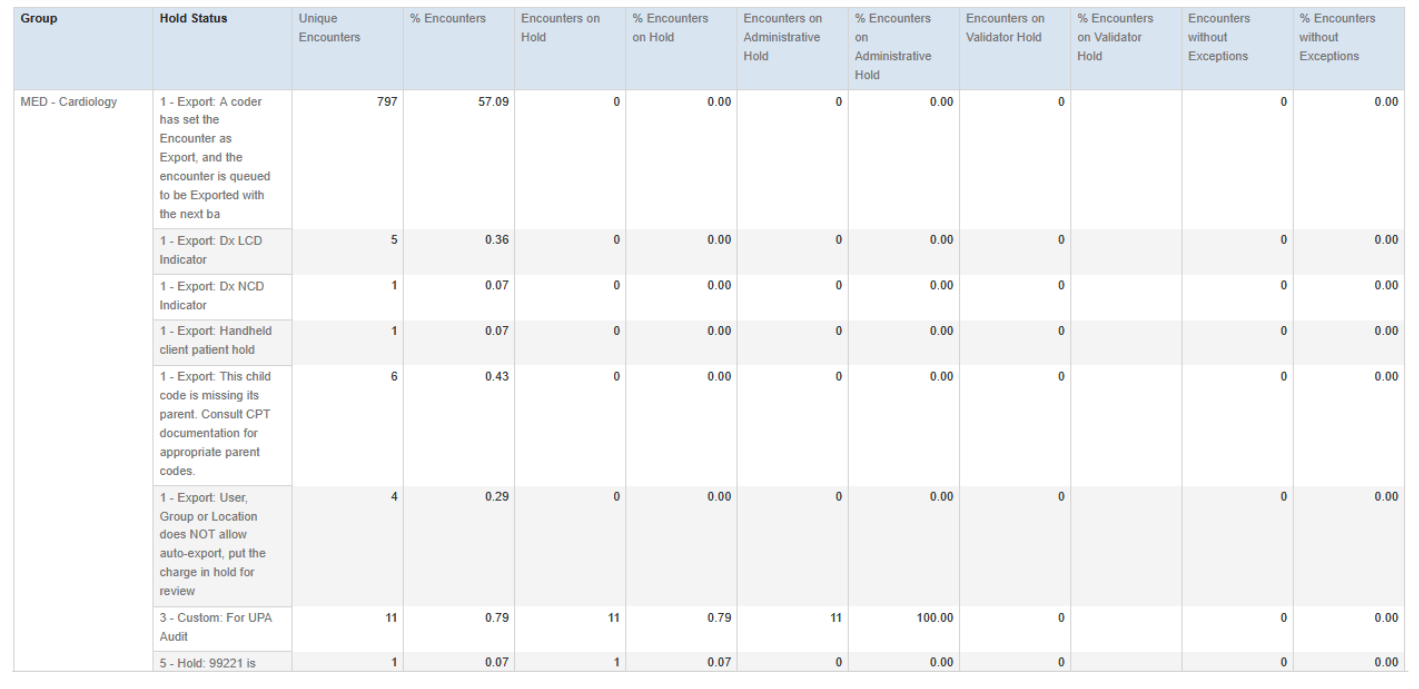

The Medaptus Charge Pro “Charge Edit Ratio Report” can help you understand your charge capture accuracy rate. It shows the percentage of encounters that hit each different coding rule or that have gone to Export without a coding rule.

2.Charge Lag Calculation (Charge Capture Time)

- Definition: Charge lag calculation measures the time from service delivery to charge entry into the system, helping organizations quantify delays in charge capture.

- Industry Benchmark: Ideally, charge capture should occur within 1–3 days of service delivery.

- Why it matters: Inaccurate or delayed charge lag calculation can slow billing cycles and negatively impact cash flow. Understanding charge lag calculation helps organizations identify workflow gaps and prevent lost or delayed charges.

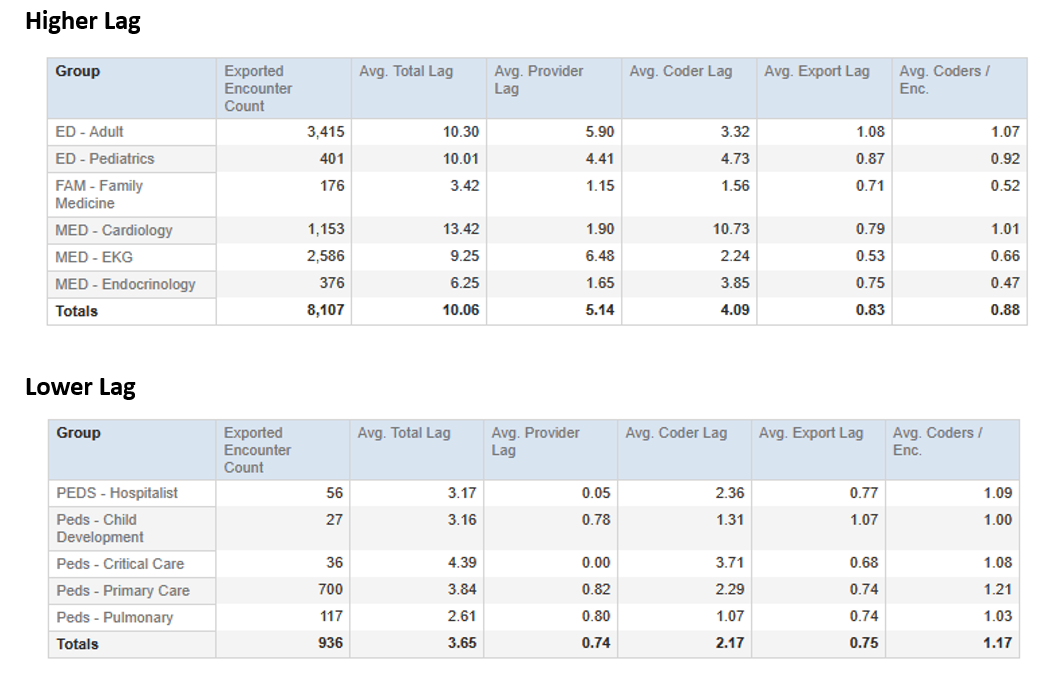

The Medaptus Charge Pro “Charge Lag Calculation” reports help identify areas with higher-than-average lag and enable teams to drill down into the root causes across departments.

3. Uncoded Charges

- Definition: The number of charges that have been entered but not yet assigned a code for billing.

- Industry Benchmark: Less than 1% of all charges should remain uncoded at any time.

- Why it matters: Uncoded charges represent lost revenue until they are processed. A higher percentage suggests issues in the coding process, either due to lack of resources or inefficiencies in charge entry. Tracking uncoded charges can help ensure that charges are being properly documented and coded quickly.

In Charge Pro, you can see your uncoded charges and how long they have remained uncoded. In this case, you’d typically have an uncharged opportunity – meaning that the patient had a provider listed as responsible (Attending, Consulting, etc.) and there is no charge at all. Usually, the only time in the application we would ever have encounters created with no codes would be if the coder put a message on a charge for the provider to go and edit it to add the codes and they haven’t yet or if we are doing charge passing where we get charges from the inbound interface and an encounter gets created without codes. In any of these scenarios, you’d be able to quickly see which charges are not yet assigned a code for billing, and why.

4. Charge Denial Rate Due to Incorrect Coding

- Definition: The percentage of denials caused by incorrect or missing codes for charge entries.

- Industry Benchmark: 3% to 5% of total claims denied due to coding issues.

- Why it matters: This metric is crucial for identifying whether errors in charge capture and coding are leading to claim rejections, affecting revenue. A higher denial rate indicates problems with charge capture or coding accuracy. Denial rates above 10% often signal systemic issues that need immediate attention.

If you’re experiencing a high denial rate, one of the things we can do is work with you to optimize your coding rules. We can evaluate if there are standard rules that need to be turned on or if there are custom rules that can be written to lower denials.

60 Days: Strategy, Optimization, and Collaboration

KPIs to Focus On:

1.Charge Capture Compliance Rate

- Definition: The percentage of charges entered and documented in accordance with internal policies and external regulations.

- Industry Benchmark: 99% or higher compliance rate.

- Why it matters: Compliance issues in charge capture can lead to costly audits, delays, and potential revenue loss. A high compliance rate ensures that charges are captured correctly and in line with billing standards.

2. Charge Capture by Service Type

- Definition: The percentage of charge capture success for different service categories (e.g., inpatient, outpatient, diagnostic).

- Industry Benchmark: At least 95% of charges should be captured for each service type, with outpatient services often presenting more challenges due to their complexity.

- Why it matters: Helps to identify specific service types where charge capture may be lacking, allowing targeted improvements in those areas.

3. Charge Reconciliation Rate

- Definition: The percentage of charges that are reconciled (compared) to the clinical documentation or patient records.

- Industry Benchmark: 95% to 98% reconciliation rate.

- Why it matters: This metric ensures that charges accurately reflect the services provided and that discrepancies are identified and resolved early. A high reconciliation rate helps prevent billing errors and revenue loss.

One of the ways to ensure that you are accurately capturing all charges from all departments is through charge reconciliation solutions. A large health system on the West Coast is currently using Medaptus’ Charge Reconciliation module so they can see all their charges and signed notes and compare them to their rounding lists to determine if the expected charge opportunity is present. This helps them reconcile where they may be missing a charge, note, or both.

4. Charge Discrepancy Rate

- Definition: The percentage of charges that do not align with clinical documentation or expected billing codes.

- Industry Benchmark: Less than 2% of charges should have discrepancies.

- Why it matters: A high discrepancy rate indicates issues with charge capture processes and suggests that further training or process adjustments are needed.

90 Days: Strategy, Optimization, and Collaboration

KPIs to Focus On:

1. Charge Capture Accuracy Rate

- Definition: The percentage of charges that were initially missed or underreported but are later captured and billed after correction.

- Industry Benchmark: 85% to 90% recovery rate.

- Why it matters: Helps track whether missed charges are being properly identified and captured after the fact, reducing revenue leakage. A high recovery rate indicates that your team is diligent in capturing overlooked charges.

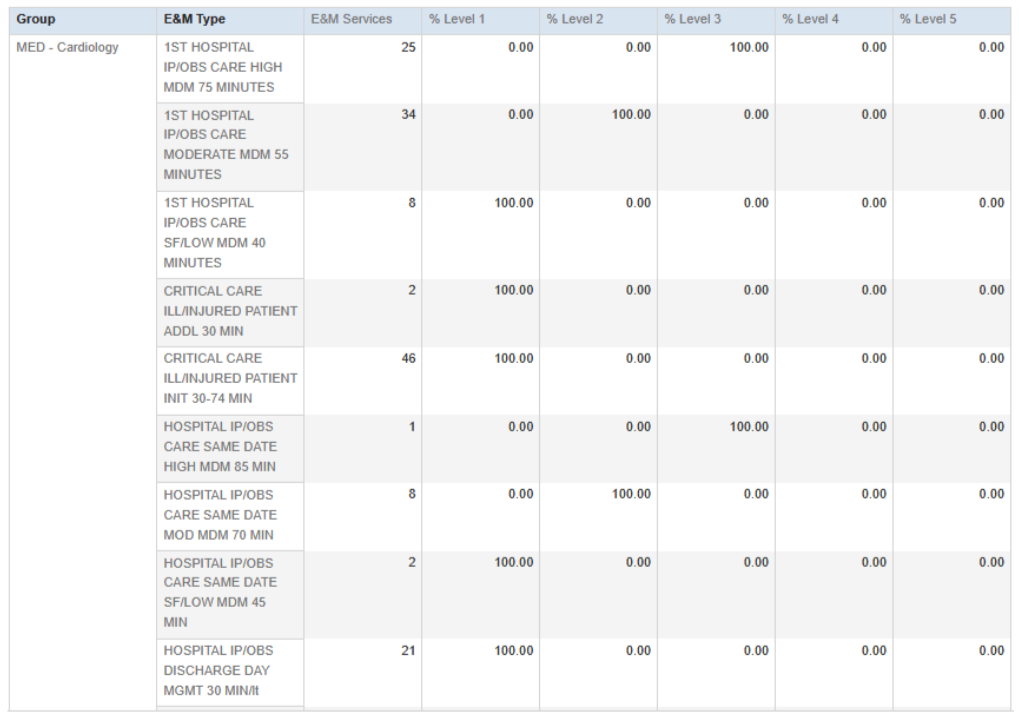

Charge Pro’s E/M Distribution Report can be used for better coding accuracy. The E&M Distribution report displays charges for Evaluation and Management codes distributed by Level. Within a family of E&M medical care procedures, e.g., outpatient/office visit for established patients, you can see where providers may be over or under coding.

2. Charge Reconciliation Cycle Time

- Definition: The average time taken to complete the charge reconciliation process from the moment of service delivery to final billing.

- Industry Benchmark: 1 to 3 days for reconciliation cycle time. Why it matters: Long reconciliation cycle times can delay revenue recognition and impact cash flow. Monitoring and optimizing this time ensures that the process is streamlined and timely.

3. Coding Compliance Rate for Charges

- Definition: The percentage of charges that are correctly coded based on clinical documentation and payer requirements.

- Industry Benchmark: 90% to 98% coding compliance.

- Why it matters: Incorrect or incomplete coding leads to claims denials and revenue loss. A high compliance rate indicates that your charge capture team is accurately reflecting services in the billing system.

4. Percentage of Charges with Errors in Reconciliation

- Definition: The percentage of charges that, when reconciled, result in errors or discrepancies (e.g., missing codes, incorrect amounts).

- Industry Benchmark: Less than 2% of charges should have errors during reconciliation.

- Why it matters: A high error rate in reconciliation suggests weaknesses in the reconciliation process, such as poor communication between clinical staff and billing teams, or inadequate charge capture workflows.

5. Charge Capture Variance by Department

- Definition: The variance in charge capture rates between different departments (e.g., radiology, surgery, emergency services).

- Industry Benchmark: Variances should not exceed 5% between departments.

- Why it matters: Variances across departments help identify where charge capture efforts are most effective and where improvements are necessary. This allows targeted interventions for underperforming departments.

Key Takeaways for Success

- Focus on Charge Accuracy: Ensuring charges are captured and reconciled accurately is foundational to maintaining a healthy revenue cycle. Continuously track metrics related to charge capture accuracy and reconciliation errors.

- Minimize Charge Lags: Speeding up charge capture and reducing charge lag time directly impacts revenue cycle efficiency. Aim to streamline workflows to ensure charges are entered in a timely manner.

- Foster Cross-Department Collaboration: Charge capture often involves clinical staff, coding teams, and billing departments. Foster close collaboration between these teams to ensure proper documentation, coding, and reconciliation.

- Use Data for Continuous Improvement: Use the KPIs to assess the effectiveness of your charge capture and reconciliation processes and implement changes where needed. Regularly review these metrics to fine-tune processes for maximum accuracy and efficiency.

- Compliance is Key: Charge capture must be both accurate and compliant. Ensure your team is adhering to payer guidelines, industry standards, and regulatory requirements to avoid penalties and ensure proper reimbursement.

Which KPIs do you measure regularly in your role? How often do you review and analyze them? By analyzing these KPIs on a regular basis, you can ensure that you’re not missing charges and maximizing your reimbursements, for improved financial profitability which ultimately lets your healthcare organization focus on what matters most: patient care. Download the PDF by clicking here.

Get the latest updates and news delivered to your inbox.

Subscribe to our newsletter today.